New Distilled Spirits Council REport Shows Tequila Leap-frogged Whiskey in U.S. Sales Last Year

The 2021 Distilled Spirits Council of the United States (DISCUS) Economic Briefing released yesterday shows tequila far outpaced whiskey – or any other spirit – in growth last year.

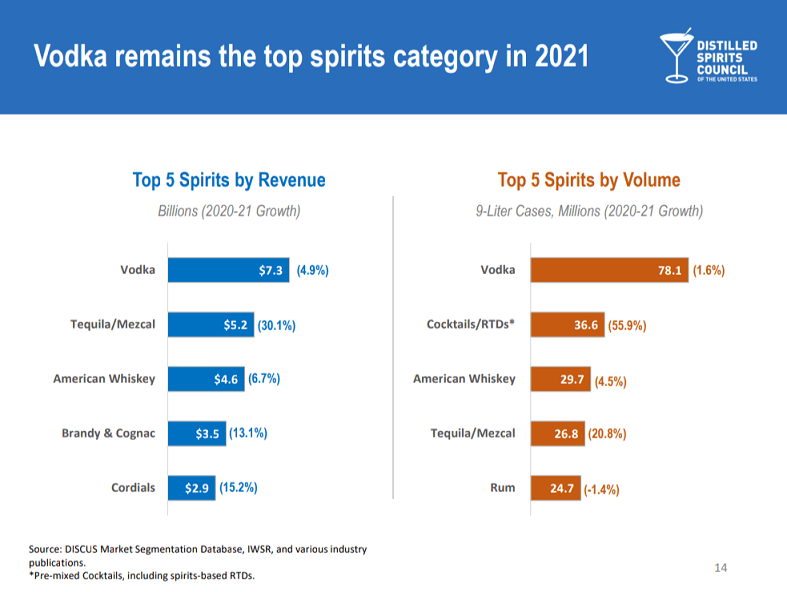

In fact, it overtook whiskey as the No. 2 economic driver in the spirits industry in the U.S. with $5.2 billion in sales, compared to American whiskey’s $4.6 billion. That leap-frog move was a reflection of tequila and mezcal’s industry growth of 30.1% . That’s in comparison to whiskey’s 6.7% growth.

Vodka somehow remains America’s favorite spirit, leading the way yet again with 7.3 billion in sales and 4.9% growth.

But the growth in tequila is remarkable, as it also gained 20.8% in sales by volume, creeping up to 20.8 million cases sold, not far behind American whiskey’s 29.7 million sold cases. (Vodka was way ahead of both at a whopping 78.1 million cases.)

But it was tequila that drove 2021 spirits industry growth, fueling a $3.8 billion leap by accounting for 31% of that growth, or a jump in sales by $1.2 billion. Whiskey, including American whiskey, Irish whiskey, Scotch, etc., grew 26%.

But the greatest overall growth is not so much a spirit category but a market segment – super-premium brands continue to become more and more consumers’ choice, based on 2021 growth. Tequila/mezcal led the way in that growth, accounting for just under 2 million 9-liter cases, with all whiskey not far behind in super-premium sales at 1.973 million.

Leading the way for premium and super-premium whiskey sales were American whiskey and Canadian whiskey. The latter saw more than 1 million in sales of super-premium cases, while American whiskey saw 646,000 cases in super-premium sales and another 494,000 in premium case sales. Irish whiskey and Scotch were well behind those in U.S. sales, although that does not reflect global sales.

Vodka super-premium sales accounted for less than a third of either tequila or whiskey. In fact, vodka showed substantial losses in both value and premium brands. Value whiskey brands also saw a downturn to the tune of 618,000 fewer cases sold in 2021 than in 2020.

Other spirits categories making the top seven for super-premium and premium sales include cordials, brandy/cognac, gin and rum.

Tequila isn’t the only rising star, however – massive growth occurred in ready-to-drink cocktails, with the industry rising by $489 million, or more than 55%. (The vast majoriy of those sales, 91%, were malt-based beverages versus spirits-based.) RTDs sold more by volume last year than did whiskey in the U.S., per the report.